My mother recently told me that she knows I'm on the spectrum.

My mother recently told me that she knows I'm on the spectrum.

Thanks DaveAsperg,

I'll look into it. I need this in order.

my advice is to wait a month after getting your diagnosis then only tell the bare minimum people at work eg HR and ur line manager thats it ---- this is confidential/medical/personal information,, mention that to HR and line manager you dont want anyone else to know.

Ask HR if your linemanager needs to know

u can decide later if you want to tell anyone else work. I I still havent., at 2 years, after diagnosis.

you will be unstable mentally for some months after getting the diagnosis whatever it is......... it could be ASD + ADHD or ASD +OCD u never know.

Thanks to everyone for the replies.

I'd like to get evaluated so I know where I am on the spectrum.

I defo have it though.

Is it good practice to declare this condition?

Is it something that should be on file?

I dread the thought of everyone at work knowing... like if it was confirmed and I had to declare it to my employers.

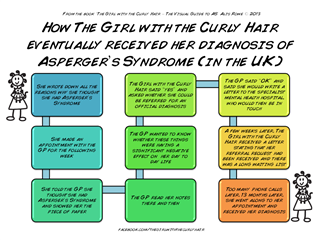

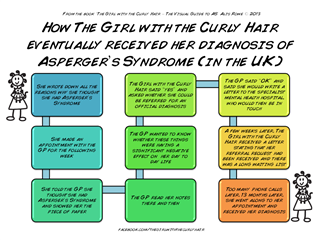

here's the plan look through it. Read aspergers as autism,, then read my below extra notes

Extra notes

Make a list of reasons why u think u are autistic.

include relatives in your family who are autistic or adhd or called weird/different

and a list of occasions when u have been called weird, autistic, different

the list should be electronic ie so you can email it to anyone who wants it.

here's the plan look through it. Read aspergers as autism,, then read my below extra notes

Extra notes

Make a list of reasons why u think u are autistic.

include relatives in your family who are autistic or adhd or called weird/different

and a list of occasions when u have been called weird, autistic, different

the list should be electronic ie so you can email it to anyone who wants it.

If you make less than £1000 per annum PROFIT, on eBay, then you are below the tax threshold.

if you used things personally then sold them , no need to declare.

it doesn’t sound like you have a worry, but should have a separate business and personal ebay account and keep an excel spreadsheet of each item listed with details of whether you used it and for how long.

if HMRC have not queried you yet, you are probably ok anyway

the top line headings I would suggest in Excel are,,,, date of purchase, name of item, cost, date of sale, price sold , postage of item, e bay expenses, was item used by me for more than 1 week yes or no. PROFIT (sale price minus costs). Gap then annual profits for 2019, 2020 etc

it should be easy to do an annual account from this.

you will have your eBay sales online and I would suggest you go back to sales since April5th 2019 and our will get your annual profits.

these are only declarable if >£1000, for items that you have not used.

should be easy!

You need to see your doctor or at least a doctor.

Some places will assess and diagnose you privately but it costs. The free option is go to your GP and ask to be referred into the NHS system for evaluation and diagnosis.

There's a good info graphic about how to get diagnosed if you Google "how the girl with curly hair got a diagnosis", that takes you through what happens when you go to your GP and ask for a referral to the nhs.

I can't do anything yet.

That's why I posted here.

How do I get myself confirmed autistic?

I know I am. Everyone knows I am, but most don't say anything about it.

I need it on record in the system. That's what I have been advised.

How do I start this procedure?

stop worrying about tax evasion,, u are not a big fish.

however u have good potential to be bigger or help charities sell their stuff.

so seek out any free Tax returns training for the self employed. Search any local Business start up initiatives designed to help people becoming self employed ( which includes self assessed tax returns )

I'm sorry to hear you went through that.

I need to find how to write up my sales with Excel. What the hell do I say to CAB for the reason I'm booking an appointment?

My problem is I've already submitted that I've made less than 1K in profit, but I've made about that in turnover.

Also I want to say I'm sorry you went through what you did in childhood. My mum left my dad for him being abusive to her and us but she then subscribed to an extreme religious view of how to deal with autism and that involved some really harsh corporal punishment for me when I strayed slightly away from neurotypical behaviours.

I realise that parents can only do their best and I don't hold anything that was done to me against her (I almost suffocated once in some weird rebirthing thing that was supposed to correct my birth trauma - don't ask because I've never worked it out). It's helpful to reflect on people's motives and I know that deep down she didn't want me to be singled out or to not have a "normal" adult life. We have a good relationship now but I still have issues with being completely unable to break rules, tell stories or try to tell a white lie as I am scared that I'll be beaten with a belt or have a stick taken to the back of my legs even though logically I know people don't do that to other adults.

You don't need to declare anything that you genuinely bought for your own personal use and then sold on. You do need to declare the things you've bought and sole on at profit.

The problem is that you've traded them off the same account so it might be hard to pick apart which money is business income and which is your own personal money from a second hand sale.

You probably do want to go to CAB and ask them to sort this out. If it helps I used to volunteer with the Scottish version of CAB and this is tiny compared to some of the stuff people used to do and then need us to fix.