I mentioned previously that I was fired unfairly on the 29th August.

And now the payment problems between my previous employer and Universal Credit!!!

Universal credit will in theory top up my earnings. And on their letters they state my 'take home pay' and how it affects the amount they will pay in a particular month.

But my previous employer is reporting 'theoretical earnings'. Not my actual take home pay.

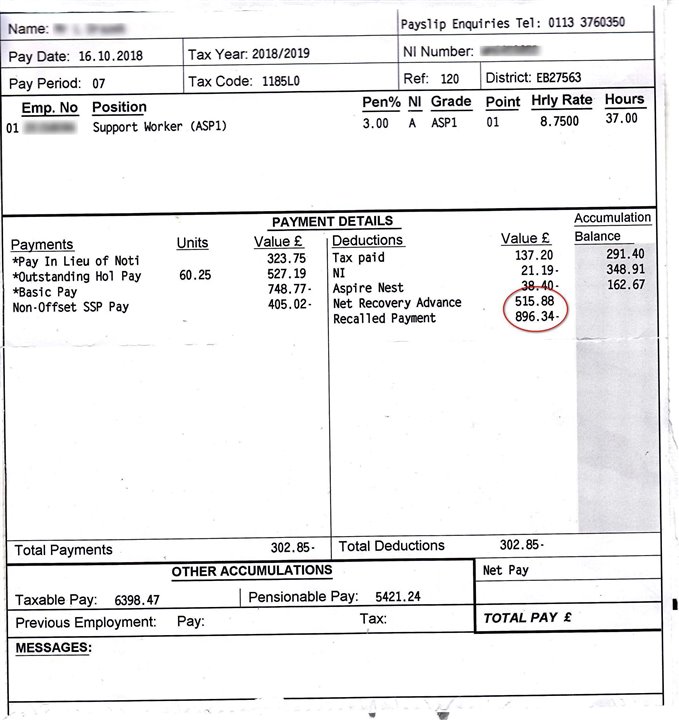

In Sept, I received a total final pay off from my ex employer of £515.88. into my bank account. My UC letter states that my take home pay was £896.34. As a result my UC payment is very low and my council tax benefit has been stopped because my pay is over the threshold.

I never received a pay slip for sept 2018.

However my ex employer has just sent me a final payslip for October 2018.

The numbers on the payslip do add up. I just don't understand all the details. I did ring the payroll department. But they gave me the runaround.

- I have highlighted in red the 515.88 that was actually paid. And the 896.34 payment that was recalled and never made. But reported to Universal Credit. I'mt sure why one is a positive deduction and the other a negative deduction.

As for the payments. I understand the pay in lieu of notice. And the holiday pay. But why is basic pay a negative payment . And what and why is non-offset SSP pay a negative payment?

Finally, over the phone they said that earnings of £327 or was it £527. Were being reported to UC for October .

But I was fired on the 29 August. And I asked. And they confirmed that they were actually making NO payment to me in October.

Help. Feeling suicidal!!!!